Losing money is not desirable but it’s normal. Managing money losses is one of the seven competences for financial success.1 If that seems odd to you, here’s the basis for the claim. Money and time are the dimensions we operate in for work and for buying and selling. We make thousands of decisions. If we allow bad decisions to haunt us, instead of teach us, we may make worse decisions in the future

A few domestic examples: yogurt is on sale. You buy it. Somehow the container gets pushed aside and your morning routine of scooping out the yogurt changes. Next time, you a ready for a serving, you find it has spoiled. You dump it out and you lose the benefit of the savings as well as the cost of the product. Another challenge is vegetables. When you are ready to use all those healthy vegetables, they are not only past their prime, they’re past their dotage.

For those who are not food centric, maybe you signed up for an app that would be free for 30 days. If you didn’t cancel, there would be a charge on your card. You forgot to cancel and paid for something you didn’t want. You can probably identify items you bought that you did not wear, or did not use, or did not like once they were in your home. If you didn’t return them, you lost money.

Perhaps, you are not troubled by these losses because individually they are small. However, over time they do add up, or said another way, they do subtract from your wealth. The losses don’t haunt you. They are just what happens in a busy life.

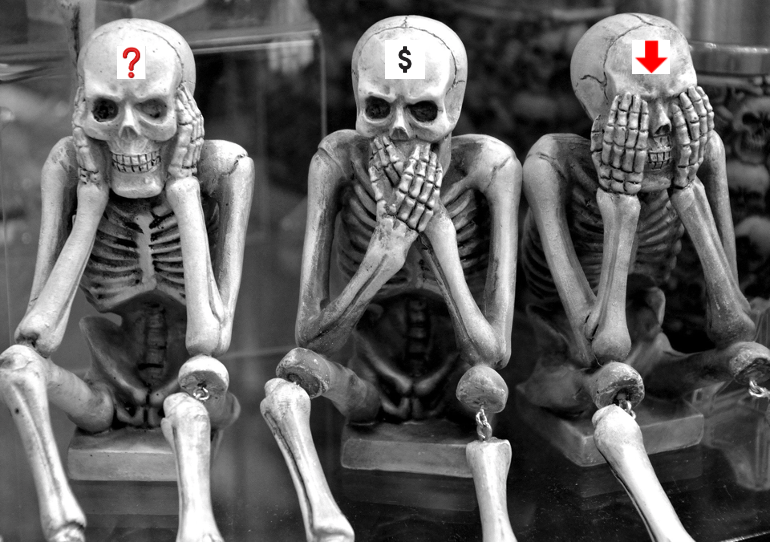

Taking a loss when you sell a stock, a bond, a house, a car, or a fund may generate a louder groan and bigger loss. The transaction may also generate responses like: “I’ll never do that again.” “I have bad luck.” “So, and so mislead me.” “My timing was bad. I should have waited to sell.” The incidents that elicit these statements are likely to haunt you and alter how you approach, or shy away from other similar transactions.

How do you get out of the haunting blame game and the nagging negatives around these losses? Here are some guidelines for achieving more competency with money losses.

1 Accept the fact that it will be rare for you to buy that car or stock, et al. at the lowest price possible or sell it at the highest price possible. You would waste a lot of your time and energy to max out on each end.

2 Understand what you need and can afford. If you are selling something, what do you need to clear in the transaction to be in the right range for your purposes? A sales price built on greed or fantasy is not a healthy approach for your own wealth building, or for your being a fair neighbor in commerce. What sort of world do you want to live in and contribute to?

3 Don’t enter a deal if you can not lose the money. You should not commit money that you need for the essentials to run your life to a hope of gain, to a “golden opportunity.”

4 Consider everything you own is illiquid. For instance, you should not buy a house assuming its value will have gone up by the time you want to sell it. The housing market could have dropped, and no one is buying, or not buying at your sales price. When you buy anything assume it is illiquid, meaning you can not get a buyer for it and that you will continue to own it. That applies to cars, electronic gadgets, and anything else you own.

“To have and to hold” used to apply to wedding vows that were expected to endure. The marketplace preaches you can dump anything, anytime. You don’t need to value your choices, be responsible for them and make the best of them. Though you may feel you are being clever, a lot of trading and dumping of whatever it is may increase your losses.

5 Research, then buy. Learn about whatever you are buying. Research the item. Talk with others who are knowledgeable and those who have had a bad experience with whatever it is. Think about what you learned from all the different voices. Take your time. Worthwhile investments are always available.

6 Keep your perspective. Loss of money is not loss of health, or loss of a loved one, or loss of freedom, or loss of time. It’s just money. Many financial losses are distressing but not life changing. If they are out of your control and are life changing, hopefully there are government programs, insurances, social programs, family, and friends who can help.

When we lose money in transactions of whatever kind, we are probably more in control of the situation than we like to admit. We will lose money. What we must not do is lose who we are, our purpose, and values. Money has many important money jobs: food, shelter, clothes, etc. Money should not be given non-money jobs like self-esteem, creating love, healing a bruised psyche.

Enjoy all the good your hard-earned money can afford you and your loved ones. Allow for your smart transactions and your foolish ones to just be part of life. We don’t say the most perfect words in every situation, and we don’t have a perfect track record with our money. Hopefully, our hearts and minds are in the right place and we can relax into the moment by moment ongoing work of developing as caring, insightful human beings, not haunted by our lapses.

1Penelope Tzougros, Wealthy Choices: The Seven Competencies of Financial Success (Wiley, 2004).

All investing involves risk including loss of principal. No strategy assures success or protects against loss. This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

Penelope S. Tzougros, PhD, ChFC, CLU. Financial Planner, Author, National Speaker. Wealthy Choices.com. 51 Sawyer Road, Suite 340, Waltham, MA 02453. Direct to Penelope 781 577 2311.

Penelope@wealthychoices.com. Fax 781 893 3565. In all 50 states, Penelope S. Tzougros is registered with, and securities and advisory services are offered through, LPL Financial, Member FINRA/SIPC. She is affiliated with Bay Financial Associates, LLC. Financial Planning is offered through Wealthy Choices® and Bay Financial Advisors, Inc. Both are registered investment advisors. Neither is a broker-dealer nor affiliated with LPL Financial.